Elliot Wave, Forex, Stock Market, Fibonacci, WD Gann, Tom Strignano (Forex Signals), Trendlines,

Monday, November 1, 2010

Thursday, October 28, 2010

Tuesday, October 19, 2010

Wednesday, October 13, 2010

Updated Chart - Scenario 1 - Could the end of this up move be near!

If this is the end of the Wave 2, god help us all. I only wish we have a 5% pull back soon so that we do not just crash on this pathetic no volume and narrow rally.

Monday, September 6, 2010

Updated Chart - Scenario 1 is Revealing Itself

Friday, July 16, 2010

THE PICTURE IS CLEARER

As "TIME" goes along the picture gets clearer. Are we about to witness a 3rd of a 3rd wave. If so I do not believe the world is ready for such an event.

I do believe "THE POINT OF RECOGNITION" has come but the question remains when will investors, speculators and governments decide to throw in the towel. The picture is telling us that the "TIME" is near and I am fear full for complacent individuals. An amazing investment opportunity is upon us over the next 3 to 6 years and one must not let fear get in its way when the worse is at hand. This outcome will not play out over night but will test the bulls and bears but ultimately we will find the terminal low where one can invest and hold for a 10 to 15 year period. This time should be a few years away but as the picture develops it maybe sooner than later.

"REMEMBER THIS IS JUST ONE MAN'S OPINION"

Friday, July 2, 2010

Sunday, June 20, 2010

Sunday, June 13, 2010

Sunday, June 6, 2010

POINT OF RECOGNITION COULD BE HERE OR NOT!

Tuesday, June 1, 2010

EURO - MONTHLY CHART IS OUR GUIDE

Thursday, May 27, 2010

Wednesday, May 26, 2010

FISHING FOR ANOTHER BOTTOM IN THE EURO

Tuesday, May 25, 2010

USDCAD - APPROACHING FIB RESISTANCE

Monday, May 24, 2010

The Markets have Showed their Hand

Wednesday, May 19, 2010

Tuesday, May 18, 2010

Friday, May 14, 2010

Wednesday, May 12, 2010

Tuesday, May 11, 2010

Monday, May 10, 2010

Where is all this Money going to come from?

Sunday, May 9, 2010

Friday, May 7, 2010

IS THIS THE BIG ONE!

Wednesday, May 5, 2010

"TIME WAS UP" & "NOW WHAT"

As per the last blog entry the "Critical Juncture", it was "Time" for the market to correct. Now the big question; “is this the start of something bigger”? As per my previous chart all markets have reached their primary targets for a meaningful reversal. The first wave down is now complete and the ensuing retracemement will give us a hint of what to expect over the next few months. It is very much possibly that we may see one more high this year as long as we stay above the February lows. The current correction was impulsive in nature so we must all be aware that this could be the big one. What I mean by that is that we could be in the midst of the 3rd wave down. The 3rd wave is never the shortest and usually the largest and most dynamic wave. If this is the case we may see the market retrace the majority or more of the rise over the last 14months. My gut feel is that we correct over the next few months to setup a year end rally that may carry into the q1 of 2011, and rise either new highs or lower highs. Therefore setting up for a major correction in the next bear market cycle in 2011 to 2013.

Forecasting is not exact but I use it as tool to understand the primary trend. It is very important to understand that flexibility is paramount in forecasting market trends. The market trends could last a lot longer than anyone can imagine thus you must always be aware of the alternate scenario. That is why when I do provide my analysis it may look like I am contradicting myself but actually I am just protecting myself. I can always guarantee that the market is going up or down but determine the trend and knowing what the primary trend can save you a lot in the long run.

"Remember this is just One Man's Opinion"

Monday, May 3, 2010

Critical Juncture

Saturday, April 17, 2010

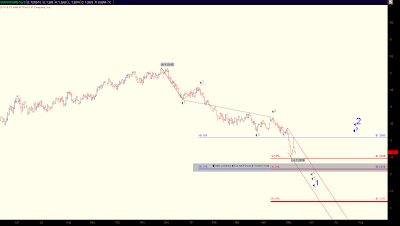

EURJPY

Could be in the midst of making a bottom based on recent price action however based on weekly Elliot wave count there is potential that wave 4 is complete and wave 5 is next to new lows.

Make or break right now is 121.055.

Buy dips into 61.8 and 82 weekly fib levels with a stop at 121.

Caution is noted because the daily trendline (TL) broke but the market did not close below TL.

Market may range between 123 and 127.

A close on the daily below 121 gives us first target level of wave 5 of 118.84.

A close above 128 exposes 132 and may attack 134.

Remember this is just “One Man’s Opinion”